Top 50 Corporate Taxpayers in the Philippines 2011

Smart is still the highest company taxpayer in the Philippines. But its income tax in 2011 (which was P10.23 billion) lowered down by over 1 billion pesos compared to its income tax on 2010 (which was P11.46 billion).

- Smart Communications, Inc. = P10.23 billion

- Manila Electric Company (MERALCO) = P8.30 billion

- Shell Philippines Exploration, B.V. = P6.39 billion

- Chevron Malampaya LLC = P6.30 billion

- Nestle Philippines, Inc. = P4.89 billion

- San Miguel Brewery Inc. = P4.78 billion

- Globe Telecom, Inc. = P4.52

- PMFTC Inc = P3.71 billion

- Petron Corporation = P2.62 billion

- SM Prime Holdings, Inc. = P2.22 billion

- Philex Mining Corporation = P1.88

- Pilipinas Shell Petroleum Corporation = P1.82 billion

- Metro Rail Transit Corporation = P1.70 billion

- First Gas Power Corporation = P1.49 billion

- Philippine Long Distance Telephone Company (PLDT) = P1.48 billion

- Manila Water Company, Inc. = P1.29 billion

- Team Sual Corporatio = P1.23 billion

- Quezon Power (Philippines), Limited Co. = P1.03 billion

- Unilever Philippines, Inc = P1.02 billion

- Philippine Amusement and Gaming Corporation (PAGCOR) = P960 million

- Megaworld Corporation = P929 million

- Lafarge Republic, Inc. = P901 million

- Manila International Airport Authority = P900 million

- San Roque Power Corporation = P885 million

- Galoc Production Company WLL = P870 million

- Emperador Distillers, Inc. = P863 million

- CITRA Metro Manila Tollways Corporation = P856 million

- Rio Tuba Nickel Mining Corporation = P852 million

- Monde Nissin Corporation = P823 million

- CE Casecnan Water and Energy Company, Inc. = P823 million

- Supervalue, Inc. = P756 million

- Kepco Ilijan Corporation (KEILCO) = P745 million

- Toyota Motor Philippines Corporation = P726 million

- San Miguel Corporation = P723 million

- Philippine Ports Authority = P718 million

- Mercury Drug Corporation = P717 million

- Ayala Land, Inc. = P714 million

- Holcim Philippines, Inc. = P703 million

- United Laboratories, Inc. = P666 million

- Siemens Power Operations, Inc. = P653 million

- Robinsons Land Corporation = P639 million

- Puregold Price Club, Inc. = P625 million

- FGP Corporation = P623 million

- Metrobank Card Corporation (A Finance Company) = P602 million

- Bank of the Philippine Islands (BPI) = P598 million

- Chevron Geothermal Philippines Holdings, LLC = P596 million

- Asian Terminals Inc. = P595 million

- Mead Johnson Nutrition (Philippines), Inc. = P584 million

- Colgate Palmolive Philippines Inc. = P579 million

- San Miguel Mills, Inc. = P565 million

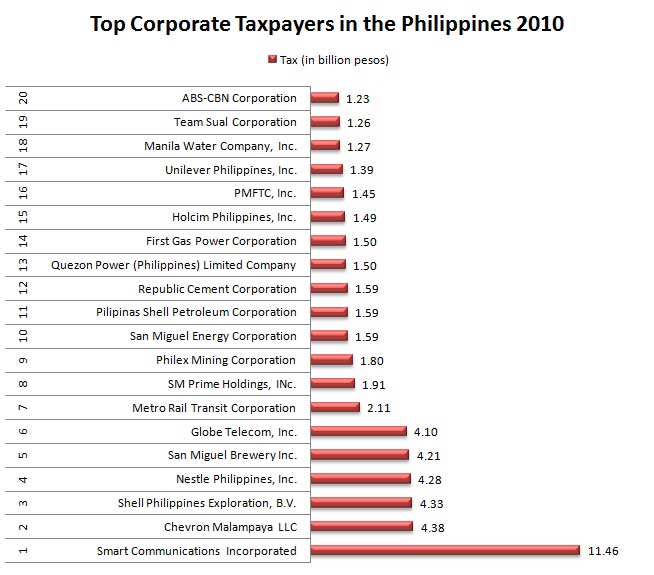

With P11.46 billion tax paid, Smart Communications, Inc. remains the highest corporate taxpayer in the Philippines since year 2010. Smart has about P7 billion greater tax paid than the second corporate taxpayer which is Chevron Malampaya LLC having P4.38 billion tax paid.

In 2009, Globe Telecom, Inc. ranked second but in 2010, this position was taken by Chevron Malampaya LLC. Globe now ranked sixth for year 2010.

| Rank | Company Name | Tax (in billion pesos) |

| 1 | Smart Communications Incorporated | 11.46 |

| 2 | Chevron Malampaya LLC | 4.38 |

| 3 | Shell Philippines Exploration, B.V. | 4.33 |

| 4 | Nestle Philippines, Inc. | 4.28 |

| 5 | San Miguel Brewery Inc. | 4.21 |

| 6 | Globe Telecom, Inc. | 4.10 |

| 7 | Metro Rail Transit Corporation | 2.11 |

| 8 | SM Prime Holdings, INc. | 1.91 |

| 9 | Philex Mining Corporation | 1.80 |

| 10 | San Miguel Energy Corporation | 1.59 |

| 11 | Pilipinas Shell Petroleum Corporation | 1.59 |

| 12 | Republic Cement Corporation | 1.59 |

| 13 | Quezon Power (Philippines) Limited Company | 1.50 |

| 14 | First Gas Power Corporation | 1.50 |

| 15 | Holcim Philippines, Inc. | 1.49 |

| 16 | PMFTC, Inc. | 1.45 |

| 17 | Unilever Philippines, Inc. | 1.39 |

| 18 | Manila Water Company, Inc. | 1.27 |

| 19 | Team Sual Corporation | 1.26 |

| 20 | ABS-CBN Corporation | 1.23 |

To have a better comparative view, you can take a look at the bar graph below and notice how SMART Communications outranked the other companies in terms of tax payment.