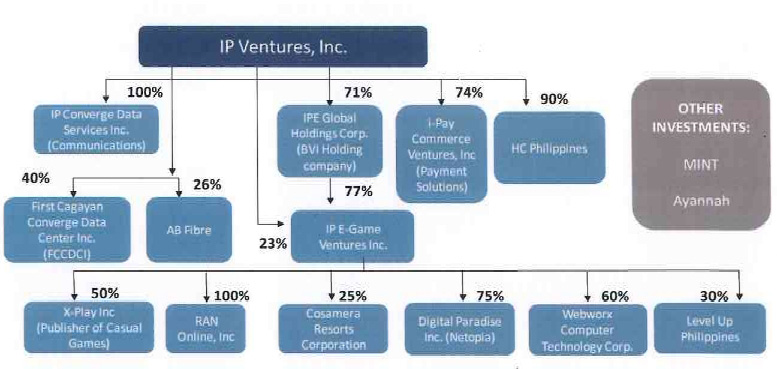

The group operates in the following industries:

In 2011, IPVG completed a restructuring program wherein it transferred all of its assets and liabilities to a private company, IP Ventures Inc. The rationale for the restructuring was to give the Company more growth opportunities and access to private capital. The restructuring enabled all shareholders to maximize their equity value by giving them shares in the newly created private company. Essentially, shareholders are now holding on to shares in IPVG, the listed company, and IP Ventures, the private company.

As a sign of confidence in the Company's business model and strategic direction, in October of 2011, Bodhi Investments LLC, a fund managed by SB China & India Holdings (SBCI), invested in IP Ventures for a 10% stake.

IP Ventures has been involved in several domestic and cross border deals (United States, India, Singapore, Philippines) and has been successful in providing profitable exits to its shareholders. Currently, the group estimates that it manages over P 5 billion worth of assets and investments under the group versus the Company's market cap of P 1 billion prior to the company's restructuring.

IP Ventures has also been able to list two of its portfolio companies on the Philippine Stock Exchange (EG and CLOUD) as well as successfully divest investments at attractive valuations (Prolexic, PCCW Teleservices, E Games publishing business).

Operationally, the Company has also formed joint partnerships with several leading players in their respective industries such as PCCW of Hong Kong, Kennet Partners of the US and UK, Blue Sky Holdings (for Highlands Coffee), GMA7, and the Philippine Star Group (largest newspaper company in the country).

Corporate Structure

Select Notable Transactions

As an investment company, IP Ventures strives to improve shareholder value through both operational know-how and seeking out of potential liquidity events. The group has listed 2 of its subsidiaries thus far, providing shareholders with exit mechanisms. The group has also been successful in divesting certain businesses and assets at attractive valuations, Below is a summary of select transactions by the IP Ventures Group.

Listings

IP Converge IPO - In December of 2010, IP Converge Data Center Inc, (PSE: CLOUD) listed its shares on the PSE. IPVG began operating the company in 2006 and have been successful in operating its data center at full capacity and consistently increasing profitability. To date, the business has 3 data center sites.In February of 2012, the shareholders of CLOUD approved the sale of substantially all its assets and liabilities to IP Converge Data Services, Inc. (IPCDS), now a subsidiary of IP Ventures, Inc. In June of 2012, IP Ventures and IPVG Employees, Inc (major shareholders of CLOUD), reached an agreement to sell roughly 79.5% of CLOUD to Januarius Resources Realty Corp, !Holdings Inc, and Kwantlen Development Corp (collectively known as the "8990 Group.") The 8990 Group is a major player in the low and mid cost real estate development sector with estimated assets over P 7 Bn and net earnings of P 500 Mn.E Games listing by way of introduction - In 2010, IP E Games Ventures (PSE: EG) was listed by way of introduction on the Philippine Stock Exchange, making EG the first and only listed on-line game publishing business in the industry. EG began operations in 2007 and quickly became the #1 gaming company in the country. The listing was a testament to the growth and profitability the company achieved over the years.

Profitable Exits

Prolexic Technologies

Recent Investments

In October of 2011, Bodhi Investments LLC, a fund managed by SB China & India Holdings (SBCI), invested in IP Ventures. Bodhi Investments signed an agreement with IP Ventures to subscribe to 10 percent of the outstanding issued shares of the Company. SBCI is a wholly owned subsidiary of Japan-based telecom and Internet services provider SOFTBANK CORP., listed on the Tokyo Stock Exchange. SBCI is the manager of the Bodhi Fund, which focuses on venture opportunities in China, India and Southeast Asia. Key areas of investment include the Internet, software, telecom value-added services, converged media, entertainment and other industries leveraging technology such as consumer-oriented services, healthcare and financial services.