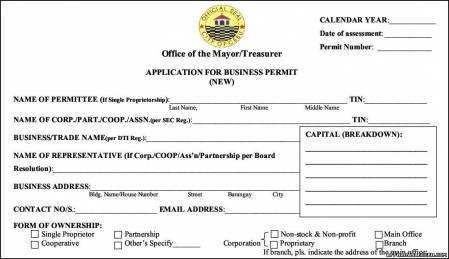

(Picture) Snapshot of the Business Permit Application Form of Cebu

DESCRIPTION :

Application of New Business Permit

As per Section 5 of the Revised Omnibus Tax Ordinance of the City of Cebu:

CLIENT/S :

Application of New Business Permit

Application of New Business Permit

Application of New Business Permit

NOTE: Application for New Business is subject for inspection of the Business area by the Joint Inspection Team

Application of New Business Permit

As per Section 5 of the Revised Omnibus Tax Ordinance of the City of Cebu:

"..any person desiring to engage in any business, trade, occupation or calling shall first submit an application on a form prescribed for the purpose, to the City Mayor, for the corresponding permit.

"…the business permit is to ensure the payment of the taxes and related fees to the city, as well as to regulate business activities for security, sanitary, safety and propriety purposes."

CLIENT/S :

Businessmen of Cebu CityCONTACT PERSON:

Zosima Sebes – Acting Division ChiefLOCATION/ADDRESS :

Contact/Telephone Number: 412-0000 loc 116

2nd Flr, Exec. Bldg / Business Taxes & Fees Division Cebu City HallAVAILABILITY:

Monday to Friday, 8:00 AM- 5: 00 PMREQUIREMENTS:

Renewal: Annually, from January 1 – 20.

Those who are renewing beyond this period are subject to additional surcharges and/or penalties.

Application of New Business Permit

I. For the Issuance of Tax Assessment:FEES:II. For the Issuance of Business Tax Payment Certificate:

- Mayor’s Business Permit Application form duly filled-up (with sketch at back portion of the form) and notarized

- Single Proprietors - Certificate of Registration from DTI (if DTI Certification not yet release, duly received application form is acceptable)

- Partnership, Corporation, Association, Foundation, etc. – Certificate of Registration, Articles of Incorporation & By-Laws of SEC

- Cooperative- Certificate of Registration

III. For the Issuance of Mayor’s Business Permit (must be complied within 60 days from the date of the issuance of BTPC)

- Tax Assessment

- Original Copy of Official Receipt of Payment for Business taxes, fees and other charges

- Original copy of the Community Tax Certificate for the current year

- All of the documents enumerated under I and II above

- Barangay Clearance where the business location belongs with official receipt of payment

- Sanitary Permit (while waiting for the release because it is after inspection, employer and employees will have Chest X-Ray and present it to City Health department to claim Health Cards)

- Real Property Tax Clearance or Certificate of No Delinquency, if the permittee owns the area of business

- Contract of Lease, if the permittee rents the area of the business

- Taxpayer’s Identification Number of the Permittee

- BIR Certificate of Registration with proof of payment (Php500) of the Business

- Business Clearance from SSS, PhilHealth and Pag-IBIG

- Requirements from National and/or Local Government relative to the kind of business applied for (This will be known after inspection)

Application of New Business Permit

Business Taxes - 0.0005 x Capital InvestmentPROCEDURES:

Permit Fee - 0.002 x Capital Investment

City Health Inspection Fee - Based on Capital Investment (max. Php 50)

Zoning Fee - Based on Capital Investment (max. Php 550)

Food & Drug Fee (in case business is food related) - Based on Capital Investment (max Php 150)

Fire Department Fee - 10% of Total Regulatory Fees

Garbage Fee - Based on the Nature and Area of the Business (Ordinance # 2018: Omnibus Tax Code-Imposition of Garbage Fee)

Community Tax Certificate - Php 20 (2% interest per month for late cedulas for single proprietorship)

Corporate Cedula - Php 500 (Basic Only)

Application of New Business Permit

| Follow these steps… | Wait while Person-in-charge… | Approach … | It will take… |

| 1. Ask for the Business Permit Application Form and your Priority Number from the Front Desk Clerk/Secretariat and fill it out. | 1. Hands out the application form for Business Permits and the Priority Number. | Violeta Aranchado Junafer Aquino | Less than a minute |

| 2. Ask for your Tax Payment TPVS from the Clerk in the Verification Area. | 2. Prints out the TPVS of the business establishment. | Hernane Alguno Arthur Echavez | 3-5 minutes |

| 3. When your number is called, give the Application Form, together with the TPVS and previous year’s Mayor’s Permit (for renewal), to the assigned evaluator for the assessment of the business taxes and related charges. | 3. Assess the Gross Annual Income of the Business Establishment. | Evaluators: Monina Paires Zosima Sebes Ethel Porcadilla Sherilyn Bandolon | Waiting time of 5-30 minutes, depending on the volume of applicants entertained; Evaluation takes about 5-15 minutes |

| 4. Receive the signed/approved assessment sheet from the evaluator. | 4. Release the approved assessment of business taxes and fees to the client. | Monina Paires, Zosima Sebes, Ethel Porcadilla, Sherilyn Bandolon | Less than a minute |

| 5. Pay the business taxes and other related charges at windows marked "Business Taxes only”. | 5. Issues the Official receipt for the payments made. | Designated collector | 15-20 minutes |

| 6. Claim your Temporary Business Permit. | 6. Releases the Temporary Business Permit after verification of supporting documents. | Victoria Holganza | 15-30 minutes |

| 7. Comply with the regulatory requirements. a) SSS Clearance – this can be processed from within/ near the BP renewal area. b) Barangay Clearance with O.R. c) Contract of Lease (if applicable) d) Previous Business Permit, with O.R. e) Sanitary Permit – owner has to apply @ CHD and wait for the inspection report from the inspection team. | 7. Evaluates the supporting documents. | Verifiers: Victoria Holganza, Hernane Alguno, Arthur Echavez, Sherilyn Bandolon | The business owner/applicant is allowed a 30-day allowance to comply the regulatory requirements. |

| 8. Submit the regulatory requirements to the Verifier. | 8. Approves the printing of the Permanent Business Permit. | Less than a minute | |

| 9. Wait while the Verifier approves and endorses the printing of the Permanent Business Permit. | 8. Approves the printing of the Permanent Business Permit | 3-5 minutes | |

| 10. Receive the permanent business permit (renewal) from the BP releasing Clerk | 9. Releases the Business Permit to the client. | Releasing Clerk from the Mayor’s Permit Section | 5 minutes |

NOTE: Application for New Business is subject for inspection of the Business area by the Joint Inspection Team