Imagine closing a failed business from 10 years ago when suddenly, the BIR comes knocking at your door, demanding you to pay Php 50,000 because of some tax return you forgot to file years AFTER you supposedly closed your business.

This scenario is a common occurrence in the Philippines because the requirements to properly close a business is not properly disseminated to our business owners.

It’s not the fault of the BIR either if they penalize you; they just follow a system that detects taxpayers who fail to file their tax returns on time. They are required to check why the taxpayer failed to file and then collect the unpaid tax. You have to understand that simply ceasing operations does not mean “closed” in the eyes of the law.

This article teaches you how to properly close a business in order to avoid lawsuits and unnecessary penalties from BIR and other government agencies.

What are the common reasons why people close a business?

1. Bankruptcy.

A business filing for bankruptcy may be due to obsolescence of their product, tough competition or unbearable interest expenses on their loans.

However, filing for bankruptcy does not mean that you don’t have to pay your creditors anymore. Under the Financial Rehabilitation and Insolvency Act or FRIA, your creditors have the option to liquidate your business and take whatever cash or property they can.

2. Poor Business Plan.

A poorly created business plan is one of the main reasons why a business is forced to close. Failure to define the goals and steps to achieve those goals makes a weak business foundation.

A business plan includes researching the following:

- The strengths of your products or services;

- Your product’s/services’ weaknesses or shortcomings;

- Your competition and what they lack; and

- Opportunities to exploit your strengths and your competition’s shortcomings.

3. Poor Management.

Having a high-quality product is a good start towards a successful business, but that’s not the end-all. Failure to properly manage your employees, your creditors, and your suppliers may be detrimental to your business.

A poorly-managed business is one that fails to use the following long-term strategies:

- Attend business seminars from reputable sources like BIR, DOLE, and TESDA to learn how to properly manage a business and its stakeholders and to know about the appropriate laws to follow;

- Hire an accountant to help you manage your finances. This will also deter theft from other employees;

- Hire a human resource manager if you have more than 20 employees; and

- Carefully read your contracts from your suppliers and creditors to make sure that you understand them so as to not risk yourself and your business from violating any condition.

4. Uncontrollable Events.

Even if you are the greatest business owner of all time, surely there are things you can’t control like your health, death, recessions or, for example, a pandemic that resulted in millions of Filipinos to be laid off and caused businesses to stop operations.

To be more precise, around 119,596 businesses in the Philippines were forced to shut down in 20203. It’s the consequence of the government imposing a months-long lockdown that basically decimated businesses, especially those that hadn’t adapted to e-commerce. The number of enterprises that closed shop translated into Php 7.767 billion in lost revenues for the government.

Having disaster avoidance plans, contingency funds and insurance might help businesses overcome tough, uncontrollable situations.

5. Business Reorganization.

Not all business closures are because of failure to operate the business properly, some want to expand or rebrand their business into another type of business (e.g. Sole proprietorship to a Corporation or a Partnership to a Corporation).

Whatever the reason is, it is necessary that you understand the pros and cons of the reorganization and to properly close the existing business to avoid incurring penalties.

6. Involuntary Closure.

The most notable example of this is when your business has been force-closed by a regulating body (e.g. SEC, DTI, DOLE or BIR) for violating a regulation or law like child labor, failure to pay taxes, fraud, etc. However, this kind of force closure will only be done after a series of careful examination, notices, and hearings.

In order not to get fined or criminalized and risk your business from being force-closed, you should follow all the laws required or hire someone who can help like a lawyer or an accountant.

How to Close a Business in the Philippines: 4 Steps.

Step 1: Determine which classification you belong to.

a. Sole Proprietorship.

This includes individual business owners including freelancers, home-based consultants, self-employed professionals, and anyone who is regularly earning income outside of an employer-employee relationship. Of course, this only applies to those who actually registered their business (which you should do if you are any of the above).

Sole proprietors are required to apply for the cancellation of their business with the Department of Trade and Industry Business (DTI).

b. Corporations and Partnerships.

Juridical persons including joint ventures, cooperatives, and other organizations required to register with the Security and Exchange Commission (SEC) are also required to apply for the cancellation of their business with the SEC.

Step 2: Complete the requirements for the cessation of business.

Before applying for business closure, it is important that you call the appropriate government agency and your local government unit in order to clarify which documents are needed.

Requirements for Closing a Business in the Philippines.

NOTE: Every document applies to all classification of taxpayers except when specifically mentioned that it is only applicable to a certain type.

1. Local Government Unit – Barangay Hall.

a. Valid ID.

- Sole Proprietorship/Freelancers/Self-employed Professionals – Valid ID of the owner;

- Partnerships – Valid ID of all Partners;

- Corporation – Valid ID of the President.

b. Barangay Clearance.

This is the most basic legal document you need to have in order to transact with other government agencies or departments. You can request this at the barangay where your business is located.

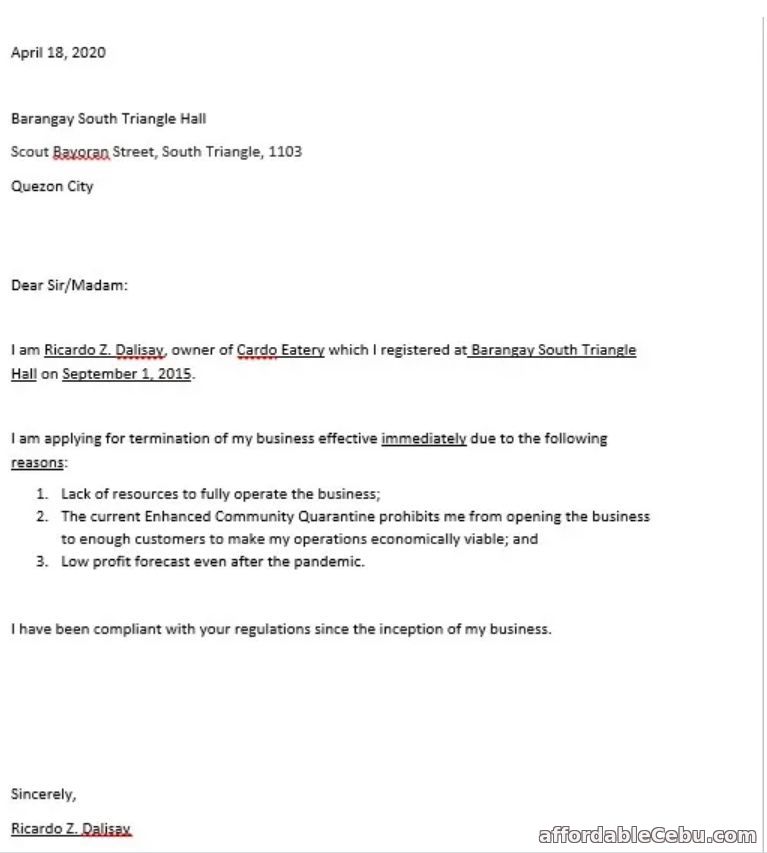

c. Letter of Request for Retirement/Closure of Business.

This letter shall signify your intention to cancel your business registration with your barangay. The letter must indicate:

- Date of application;

- Contact details of the addressee (the Barangay Hall);

- Name of the applicant;

- Registered business name;

- Date of registration with the government, in this case, the barangay;

- Business permit number;

- Reason/s for the closure of business;

- Proposed date of closure; and

- A declaration that the business has no outstanding obligation or liability with the barangay.

2. Local Government Unit – City Hall.

a. Valid ID.

- Sole Proprietorship/Freelancers/Self-employed Professionals – Valid ID of the owner;

- Partnerships – Valid ID of all Partners;

- Corporation – Valid ID of the President.

b. Barangay Clearance.

c. Barangay Certificate of Closure Indicating Date of Closure.

This shall be proof that you already settled all existing liabilities and successfully closed your business at the barangay level.

d. Latest Business Permit.

You must submit the original copy of the latest business permit available.

e. Affidavit of Closure, Board Resolution or Notice of Dissolution Indicating the Exact Date of Closure.

NOTE: Affidavits are required to be notarized.

Sole Proprietorship.

If you are a sole proprietor, your affidavit of closure must include the following:

- Name of the owner;

- Address of the business;

- Registration No. from DTI and/or BIR;

- Date of Closure;

- Reason for closure;

- That the business has no outstanding liabilities.

Partnership.

Original Partnership Dissolution Agreement or Notice of Dissolution indicating the exact date of closure. This document basically sets how the property and obligations of the partnership will be divided among all partners.

Corporation.

Original Board Resolution or Corporate Secretary Certificate on the closure of business indicating the exact date of closure.

f. BIR Form 2303 or Certificate of Registration.

The original copy must be presented while a photocopy must be submitted. This shall be proof that you registered with the BIR during the course of your business.

g. Latest ITR and Financial Statements.

The latest income tax returns and financial statements (e.g. Balance Sheets, Income Statement, Statement of Cashflows, etc.) for the three (3) preceding years of the retirement date must be photocopied and submitted to the City Hall where your business is located.

h. Latest VAT and OPT Returns.

The latest business taxes filed from the last payment of business permit up to the date of closure must be photocopied and submitted to the City Hall where your business is located.

i. Books of Accounts.

The City Hall where your business is located may request that you present your books of accounts to be examined by their staff.

j. If with branches, proof of business tax payment from the LGUs governing the branches.

This shall be proof of your compliance with other LGUs.

3. Bureau of Internal Revenue (BIR).

a. Letter of Request for Retirement/Closure of Business.

This letter shall signify your intention to cancel your business registration with the BIR. The letter must indicate:

- Date of application;

- Contact details of the addressee (the RDO where you registered;

- Name of the applicant;

- Registered business name;

- Date of registration with the BIR;

- Certificate of Registration Number;

- Reason/s for the closure of business;

- Proposed Date of Closure; and

- A declaration that the business has no outstanding obligation or liability with the BIR.

b. BIR Form 2303 or Certificate of Registration.

c. Books of Accounts.

d. Death Certificate.

This is required in case of closure due to the death of the sole proprietor.

e. List of ending inventory of goods, supplies, and other properties of the business (e.g. Debit memos, Delivery Receipts, Purchase Orders, etc.).

f. Inventory of unused sales invoices and official receipts.

g. Ask for Receipt Poster.

h. Latest ITR and Financial Statements for the three (3) preceding years of the retirement date.

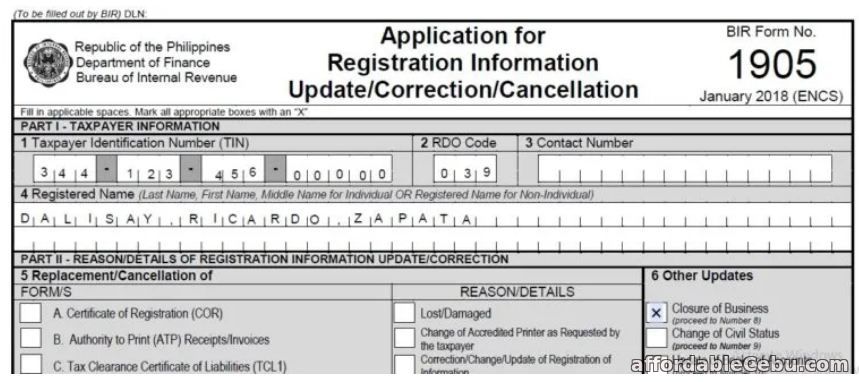

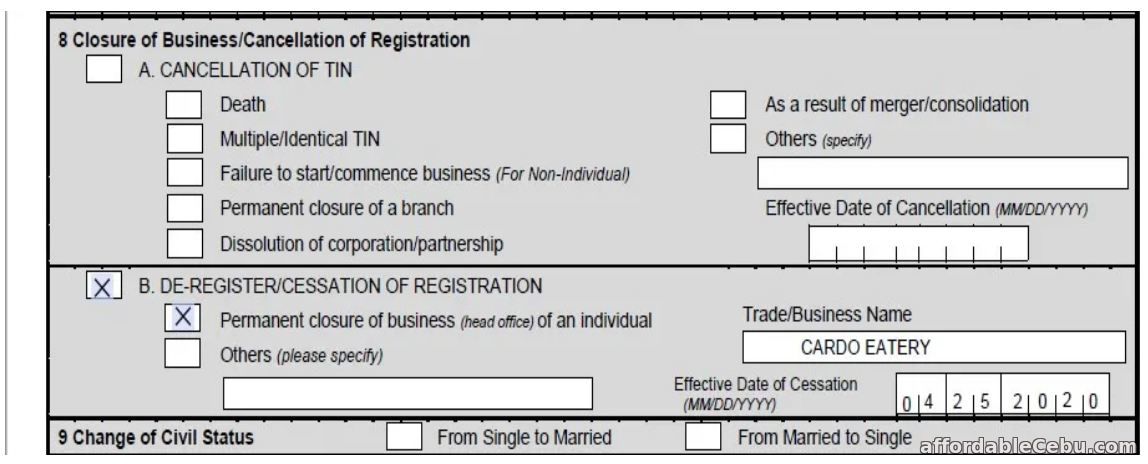

i. Duly accomplished BIR Form 1905.

Sole Proprietor.

As an individual taxpayer in the Philippines, it is recommended that you do not cancel your TIN while you apply for the closure of the business.

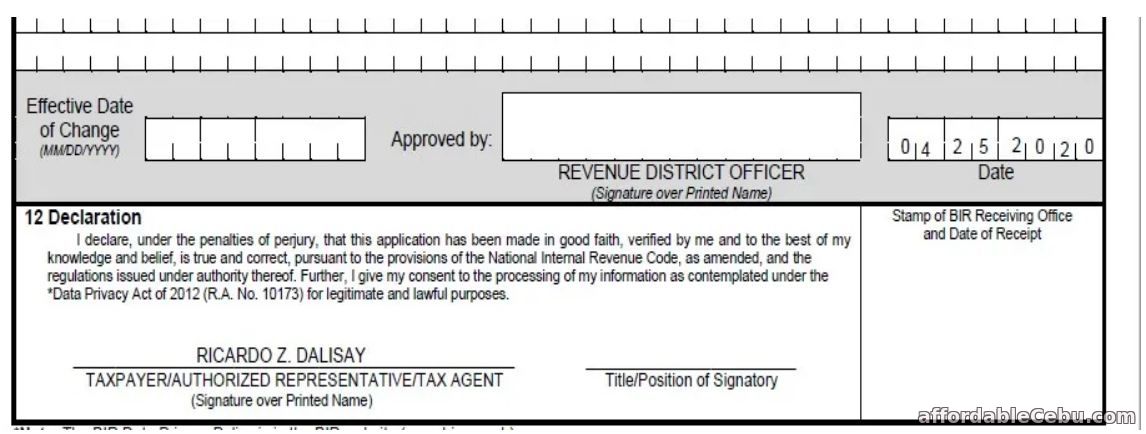

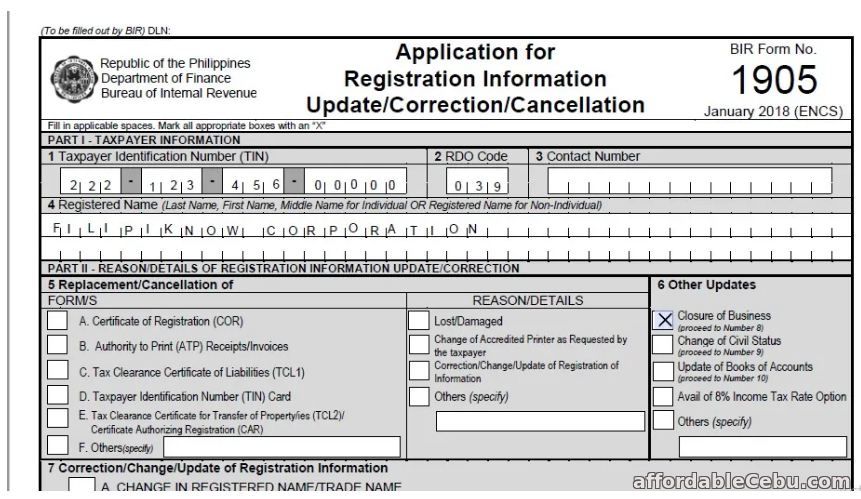

Sample Filled Out BIR Form 1905 for Sole Proprietors:

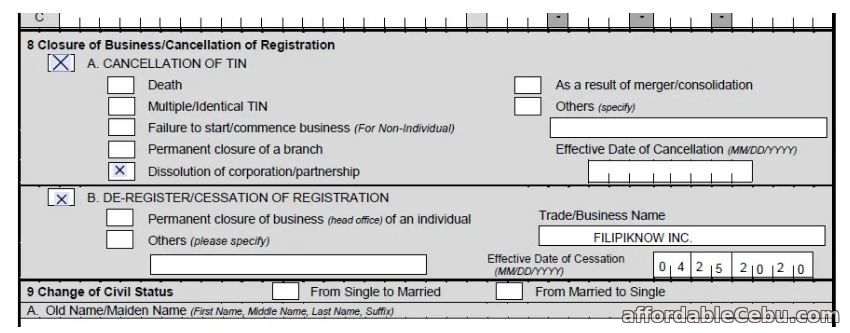

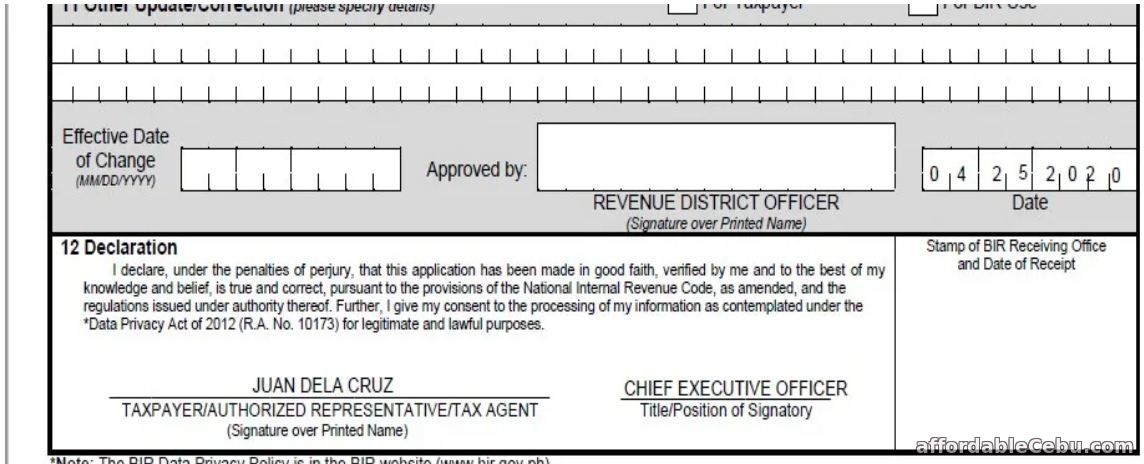

Partnerships and Corporations.

Closing a partnership or a corporate business requires that the TIN of the Juridical Person is also canceled.

Sample Filled Out BIR Form 1905 for Partnerships and Corporations:

j. Board Resolution/Notice of Dissolution for Corporations and Partnerships.

Corporation.

Your RDO may require you to present a copy of the board resolution of approval of the dissolution of the corporation.

Free Download: Sample Template of Board Resolution for Business Closure

Partnership.

Your RDO may require you to present a copy of the notice of dissolution.

Free Download: Sample Template of Notice of Dissolution for Partnerships

k. City Hall Certificate of Closure Indicating Date of Closure.

This shall be proof that you already settled all existing liabilities and closed your business at the city hall level.

l. Latest Authority to print issued and Form 0605 (Annual Registration).

4. Department of Trade and Industry (DTI).

a. Letter of Request for Cancellation of Business Name.

This letter shall signify your intention to cancel your business name. The letter must indicate:

- Date of application;

- Contact details of the addressee (DTI Head Office);

- Name of the owner/partner/president, whichever is applicable;

- Registered business name;

- Date of registration of the business name;

- Certificate of Registration Number;

- Reason/s for the closure of business; and

- Proposed Date of Closure.

Free Download: Sample Template of Letter of Request for Cancellation of Business Name (DTI)

b. Affidavit of the Cancellation of the Registered Business Name.

Stating the reason/s for closure and at the time of the closure, that the business has no outstanding financial obligation in connection with the operation.

Free Download: Sample Template of Affidavit of the Cancellation of the Registered Business Name

c. Original copies of the business name certificate of registration.

d. Affidavit of Loss of BN Certificate or Certificate of Registration, if applicable.

e. Certified photocopy of the SEC certificate of dissolution of the corporation/partnership.

5. Securities and Exchange Commission (SEC).

a. Director’s Certificate.

This is a notarized document used to certify the decision of the corporation to dissolve. This is only used in cases where the corporation voluntarily wants to dissolve and close its business.

b. Articles of Incorporation.

c. Amended Articles of Incorporation (if any).

d. Articles of Partnership.

e. Audited Financial Statements (AFS).

f. BIR Tax Clearance Certificate.

This shall be proof that you already settled all existing liabilities and successfully closed your business at the BIR.

g. Notarized Secretary’s Certificate.

h. Clearance from other government agencies (e.g. PEZA, BOI, BMBE etc.).

This is applicable only to corporations with secondary licenses.

i. Publisher’s Affidavit of the Publication of Notice of Dissolution.

This is a sworn statement by a publisher (newspaper) that a notice of dissolution of a corporation was given on specific days. This shall be done at least once a week, for three (3) consecutive weeks. The format of the affidavit shall be given by the publisher.

Step 3: Officially announce the closure of business to your stakeholders.

Announcing that your business will be closing soon may seem unnecessary but not only will it help you smoothly transition into your next plan, but it is also legally required by different government departments.

Your stakeholders are all the people and businesses that have an interest in your business. These are your:

a. Employees.

DOLE requires employers to notify their employees that the business is closing at least 30 days from the intended date of closure. Also, separation pay must be given to the employees if the closure is not due to bankruptcy or insolvency.

To properly announce the termination of employees due to the closure of business, the company must:

- Send individual termination letters to the employees and DOLE Regional office where the employee is located stating: (1) The reason for termination (e.g. due to closure of business); (2) That the notice was given within 30 days from the day of closure; and (3) That a separation pay will be given to the employee. The Notice of Termination is valuable as it’s one of the requirements that the employees need should they decide to avail of the SSS unemployment insurance, a cash benefit they can use to stay afloat while looking for a new job.

- Conduct a company-wide meeting explaining what will happen to them, what they will receive etc. This is also the time to answer employees’ queries and address their concerns regarding their job status. It is important to be as transparent as possible. This is optional but as significant as losing one’s job, it is polite to properly address their worries.

Failure to follow the above requirement is a ground for an illegal dismissal lawsuit.

b. Suppliers and Creditors.

Simply calling or emailing your suppliers and creditors, notifying them about your intention to close your business, is enough. However, you must still follow the contracts made with your supplier and creditors in the event of closure of business so as to make sure that you do not violate any provision or term in the contract.

Failure to observe this process is a ground for a lawsuit from your supplier or creditor.

c. Regulatory Agencies.

You need to notify the relevant government agencies that regulate your business in order to get government clearances that would signify that you are compliant with the laws. For more information, please see Step 4.

d. Shareholders and Business Partners.

Closing a juridical entity like a corporation or a partnership must undergo a series of meetings and decision-making made by its owners.

For a partnership, the partners shall notify the other partners that a meeting with the agenda to dissolve the partnership will commence. This is done preferably via email.

For a corporation, at least twenty (20) days prior to the meeting, notice shall be given to each shareholder by any means authorized under its bylaws, stating that the corporation shall be dissolved. Then at the meeting, the shareholders and the directors shall vote on whether or not the corporation shall be dissolved.

e. Customers.

In order to notify your customers, you could post a written notice within the vicinity of the business stating that the business will close on the proposed date. You also have the option to call key customers and inform them that you will no longer be doing business with them.

This is optional but it is not bad to still have a healthy relationship with your key customers because they were the ones that helped you build your business.

f. Other ways to announce the closure of your business.

- Via your website – a letter to your stakeholders announcing the closure of your business including the details of the closure.

- Via newsletters or social media groups/pages – You may issue a statement detailing the facts of the closure and how it may affect local businesses in your area. This is recommended for big enterprises that have a large impact on the local economy to enable other local businesses to adjust to the changes brought by the cessation of your operations.

Step 4: Submit requirements to appropriate government agencies to obtain the required clearances.

Before we proceed, please take note of the following:

- Before applying for the closure of your business, you need to settle all your pending cases with the BIR, DOLE, DTI, and/or SEC.

- The government does not know when you actually stopped your business operations that’s why they still expect you to comply with your obligations until you get the appropriate government clearance (e.g. Filing Tax Returns; Mandatory Contributions for SSS, Philhealth, and Pag-IBIG; Payment of local government fees and taxes like business permits).

a. Closing a Sole-Proprietorship/Freelance/Self-employed Professionals.

i. Notice of Closure to DOLE, SSS, PhilHealth, and Pag-IBIG.

- Send a service of a written notice to the employees and the DOLE at least one (1) month before the intended date of closure/cessation. This will lower the risk of getting illegal dismissal lawsuits.

- Update SSS, PhilHealth, and Pag-IBIG registration to Unemployed or Employed, whichever is applicable. This will allow you to control your mandatory contributions and notify them that you no longer have employees.

ii. Application for Closure at your LGU – Barangay.

- Create a Letter of Request for Retirement/Closure of Business

- Present the required documents (see Step 2 for the list of requirements) to the Barangay Hall where your business is located.

- Pay the necessary fees, including unpaid business permits or, depending on the LGU, facilitation fees.

- Claim Barangay Certificate of Closure which shall be used as a document to apply for closure of business at the City Hall Level.

iii. Application for Closure at your LGU – City Hall.

- Create an Affidavit of Closure/Dissolution Indicating the Exact Date of Closure.

- Present the required documents (see Step 2 for the list of requirements) to the City Hall where your business is located.

- Depending on the LGU, there are application forms needed to be filled out. These application forms need only basic information.

- Pay the necessary fees, including unpaid business permits or, depending on the LGU, facilitation fees.

- Claim City Hall Certificate of Closure which shall be used as a document to apply for closure of business at the BIR.

iv. Application for Closure at BIR.

- Fill-out BIR Form 1905.

- Create a Letter of Request for Retirement/Closure of Business.

- Present the required documents (see Step 2 for the list of requirements) to the RDO where your head office is located.

- If necessary, file for short period tax returns when you decide to end your business in the middle of a taxable year.

- Destroy all the unused sales invoices/ official receipts, accounting forms, business notices, and the Certificate of Registration in front of a BIR Personnel and Official.

- Wait for the RDO to verify that you have no open cases, delinquent cases and after a tax audit, verify that you have no more outstanding liabilities with the Bureau.

- Pay the necessary fees and other deficiency taxes.

- Claim Tax Clearance.

- In case of death or if the taxpayer chooses to cancel the TIN, receive a confirmation that the TIN no longer exists in the data of the BIR

v. Application for Cancellation of Business Name at DTI.

- Create a Letter of Request for Cancellation of Business Name.

- Create an Affidavit of Cancellation of the Registered Business Name.

- Create an Affidavit of Loss in case you lost the Certificate of Registration of Business Name.

- Present the required documents (see Step 2 for the list of requirements) to the DTI Head Office.

- Claim Certificate of Cancellation of Business Name.

b. Dissolution and Closure of a Corporation and a Partnership.

i. Notice of Closure to DOLE, SSS, PhilHealth, and Pag-IBIG.

Send a service of a written notice to the employees and the DOLE at least one (1) month before the intended date of closure/cessation. This will lower the risk of getting illegal dismissal lawsuits.

ii. Application for Closure at your LGU – Barangay.

- Create a Letter of Request for Retirement/Closure of Business.

- Present the required documents (see Step 2 for the list of requirements) to the Barangay Hall where your business is located.

- Pay the necessary fees, including unpaid business permits or, depending on the LGU, facilitation fees.

- Claim Barangay Certificate of Closure which shall be used as a document to apply for closure of business at the City Hall Level.

iii. Application for Closure at your LGU – City Hall.

- Provide Board Resolution in case of Corporations or Notice of Dissolution in case of Partnerships.

- Present the required documents (see Step 2 for the list of requirements) to the City Hall where your business is located.

- Depending on the LGU, there are application forms needed to be filled out. These application forms need only basic information.

- Pay the necessary fees, including unpaid business permits or, depending on the LGU, facilitation fees.

- Claim City Hall Certificate of Closure which shall be used as a document to apply for closure of business at the BIR.

iv. Application for Closure at BIR.

- Fill-out BIR Form 1905.

- Create a Letter of Request for Retirement/Closure of Business.

- Present the required documents (see Step 2 for the list of requirements) to the RDO where your head office is located.

- If necessary, file for short period tax returns when you decide to end your business in the middle of a taxable year. This shall be done within 30 days from the adoption of the resolution to dissolve or when it was notified by the SEC to dissolve.

- Destroy all the unused sales invoices/ official receipts, accounting forms, business notices, and the Certificate of Registration in front of a BIR Personnel and Officials.

- Wait for the RDO to verify that you have no open cases, delinquent cases and after a tax audit, verify that you have no more outstanding liabilities with the Bureau.

- Pay the necessary fees and other deficiency taxes

- Claim Tax Clearance.

v. Application for Dissolution at SEC.

- Obtain Clearance from other regulatory agencies if your corporation has secondary licenses (e.g. PEZA, BOI, BMBE, etc.).

- Present the required documents (see Step 2 for the list of requirements) to the SEC.

- Claim Certificate of Dissolution from SEC

vi. Application for Cancellation of Business Name at DTI.

- Create a Letter of Request for Cancellation of Business Name.

- Create an Affidavit of Cancellation of the Registered Business Name.

- Create an Affidavit of Loss in case you lost the Certificate of Registration of Business Name.

- Present the required documents (see Step 2 for the list of requirements) to the DTI Head Office.

- Claim Certificate of Cancellation of Business Name.

What are the benefits of properly closing a business in the Philippines?

1. Government clearance.

Once you’re validated for the closure of business in a government agency, the agency will provide you with a government clearance. This shall be used as proof that you are compliant with all their regulations.

One example is the BIR Tax Clearance which signifies that you have no existing tax liabilities and open cases. This shall be used when you apply for a new business, cancel your business name, property auctions, and for immigration purposes.

2. Moving on and learning from your mistakes.

Losing a business, especially those inherited from previous generations, will hit you hard. Regardless of the reason for the closure of the business, you will learn something that may be useful for future businesses you’ll create. Even if you choose to never venture again in the commerce of trading or providing services, the experiences you gained are priceless.

Tips and Warnings.

1. Consult a professional if needed.

If you plan on dissolving or closing your business, it’s always helpful to find a professional who will assist you (e.g. an accountant or lawyer). The benefits of their services are often worth the cost, considering that the penalties for failing to properly close your business are very hefty.

2. Call the government agency for clarification.

The process of closing your business is complicated and requires a lot of research. Thankfully, if you just take the time to call each government unit, they will assist you with the procedures and the exact requirements they need.

Frequently Asked Questions.

1. What are the penalties for not closing the business properly?

2. I am just a freelancer/small business owner. Am I also required to file for business closure?

Yes. As long as you are a registered owner of a business and you decide to permanently close your business, then you should follow the steps provided in this guide to properly close your business.

3. How long does it take to close a business in the Philippines?

There is no specific timeframe; it may take a week or more than a year. It all depends on how compliant you are with the laws, years of business operation, the nature of your business, and whether your business is a sole proprietorship or a corporation/partnership.

4. If my business didn’t operate do I still have to formally close my business?

For individual owners, as long as you still don’t have a business permit from your LGU and the BIR, you don’t have to cancel your other permits.

For Corporations, your SEC registration will be revoked if the corporation didn’t start operations within 5 years from the date of incorporation or becomes inoperative within 5 consecutive years. If that happens, the corporation needs to immediately apply for dissolution and closure.

5. What rights do employees have when a business is terminated?

If your employer didn’t declare bankruptcy, you are entitled to:

- Have a 30-day Notice of Termination; and

- Separation Pay.

If your employer failed to provide the above, you may file a lawsuit against them.

6. Does closing my business mean canceling my TIN?

If your business is classified as a sole proprietorship, then we recommend that you do not cancel your TIN (Tax Identification Number) because if you plan on earning income within the Philippines, you’ll need to reapply for another TIN.

However, if your business is a corporation or a partnership, dissolving the business means canceling the TIN. This signifies that the identity of the juridical person is now non-existent.

7. Does closing one of my businesses affect my other businesses?

No. As long as the business permits are separate and/or each business has its own TIN.

8. I want to assume the business of my relative. Do we still have to close the business?

Currently, there is no way to transfer ownership of a sole-proprietorship business and partnerships. Your relative would need to close their business and cancel its business name so that you can adopt the same business type.

However, ownership is transferable for corporations. You may become a major stockholder and control the corporation yourself.

9. What happens to my business when I die?

If you own a sole proprietorship business or you are a partner in a partnership, the business needs to be dissolved if you die. This means that if you die, you take your business with you. But nothing stops one of your heirs to create an exact type of business like the one you previously owned.

If you own a corporation, your shares in that corporation may be assumed by your heirs and they can just continue the business from there.

- https://www.affordablecebu.com/