The Fund aims to preserve capital and generate income from low-risk fixed income securities with a portfolio weighted average life of not more than one (1) year.

The Fund is suitable for risk-averse individual and corporate investors who are looking for safe and liquid investments with yields relatively higher than those of savings and time deposit accounts. In order to minimize risks and maximize earning potential, participants/trustors are recommended to stay invested in the Fund for at least six (6) months.

ALLOWABLE / PROSPECTIVE INVESTMENTS

The following are the investment outlets where the Trustee may invest the Fund in, depending on their availability or other market circumstances: Deposits in the trustee’s bank or in other banks, securities issued or guaranteed by the Philippine Government or the BSP, tradable securities issued by any supranational entity, exchange-listed fixed income securities, collective investment plans of the trustee/other trustees and such other tradable investment outlets/categories allowed for UITFs by BSP and approved by the Trustee’s Trust Committee as suitable for the Fund. The Fund may also engage in derivative instruments for hedging, subject to the guidelines set by BSP for such activities and duly approved by the Trustee's Trust Committee.

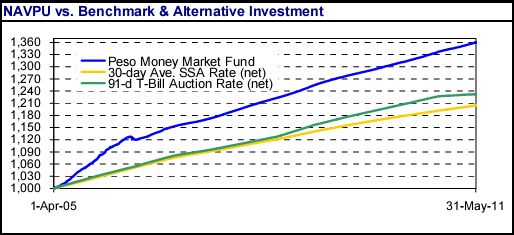

FUND PERFORMANCE (Absolute Return, net of tax and fees)

| Period | BDOPMMF | Benchmark | Alternative |

| One Month Ago | 0.25% | 0.19% | 0.09% |

| Three Months Ago | 0.85% | 0.53% | 0.22% |

| Year to Date | 1.29% | 0.84% | 0.33% |

| One Year Ago | 3.44% | 2.09% | 1.90% |

| Three Years Ago | 11.57% | 7.73% | 9.63% |

| Five Years Ago | 21.08% | 14.70% | 17.03% |

| Since Inception | 36.12% | 20.61% | 23.40% |

The Fund's benchmark is the Bloomberg Ave. 30-day Special Savings rate

The estimated return on the alternative investment refers to the compounded daily return of the latest auctioned 91-day T-Bill, adjusted for tax.

PORTFOLIO STATISTICS

| April 29,2011 | May 31, 2011 | |

| Weighted Average. Duration | 0.40 | .30 |

| Volatility, Past One Year | 0.17% | 0.16% |

| Sharpe Ratio | 8.2 | 9.38 |

| Information Ratio | 9.63 | 10.29 |

| Weighted Ave. Yield (net) | 3.05% | 3.23% |

Sharpe Ratio is used to characterize how well the return of a Fund compensates the investor for the risk taken. The higher the number, the better.

Information Ratio measures reward-to-risk efficiency of the portfolio relative to the

benchmark. The higher the number, the higher the reward per unit of risk.

Net of taxes and trust fees

TOP TEN HOLDINGS

| Issue | Coupon Rate | Maturity | % of Portfolio |

| SDA | 4.6875% | 06/30/11 | 4.05% |

| IOSDI | 4.8750% | 07/01/11 | 3.71% |

| SDA | 4.6875% | 06/21/11 | 2.45% |

| IOSDI | 4.7500% | 07/04/11 | 2.41% |

| SDA | 4.6875% | 06/13/11 | 2.41% |

| SDA | 4.6875% | 06/21/11 | 2.34% |

| TD-OTHER BANKS | 4.2500% | 1/13/12 | 1.86% |

| TD-OTHER BANKS | 4.2500% | 1/16/12 | 1.86% |

| SDA | 4.6875% | 06/16/11 | 1.82% |

| Petron Bond 2017 | &.0000% | 11/10/17 | 1.76% |

OTHER FUND FACTS

| Bloomberg Ticker | BDOPMMF <Index> |

| Fund Type | Money Market Fund |

| Inception Date | April 1, 2005 |

| Net Asset Value (NAV) | Php 27.061 Billion |

| NAV per unit (NAVPU) | Php 1,359,8331 |

| Par Value | Php 1,000.00 |

| Minimum Investment | Php 100,000.00 |

| Minimum Additional | Php 100,000.00 |

| Minimum Holding Period | None |

| Early Redemption Fee | None |

| Trust Fee | 0.50% p.a |

| Custodian | Deutsche Bank AG, Manila Branch / Standard Chartered Bank |

| Dealing Period | Up to 11:30 am of any banking day the notice of redemption is received |

FUND MANAGER'S REPORT

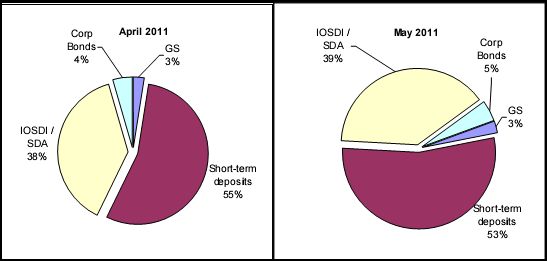

Monetary authorities proved that they were determined to contain inflation as they found it prudent to further tighten monetary policy by increasing the key overnight rate by another 25 basis points to 4.50% during their scheduled meeting last May 5. BSP’s SDA rates followed suit, rising to 4.6875% for one-month placements. Time deposit rates and interprofessional repo rates likewise went up to the 4.75%- 4.875% range for over-the-quarter placements. As a result, demand for T-bills cooled down, causing the Bureau of Treasury to reject 182- and 364- day bids while partially accepting 91- day bids at 1.889% from a low of 0.568%. During the month, the Fund Manager increased exposure in corporate issuances and shifted to TD placements.

BDO PORTFOLIO COMPOSITION

DISCLAIMER: The views expressed in this Update by BDO-Trust are strictly for information purposes only. The UITFs are not deposit accounts but trust products. Participation in UITFs does not guarantee a rate of return and are not covered by the Philippine Deposit Insurance Corporation (PDIC). BDO UITFs are likewise not guaranteed by BDO. Investment or participation in the UITFs are subject to risk and possible losses of principal. The value of the investments can go up or down and, upon redemption, may be worth more or worth less than the original amount invested. BDO-Trust is not liable for such losses, which are for the sole account of the participant/trustor. Thus, it is important that the investor always considers if these Funds are aligned with his financial goals, investment horizon and risk appetite. The UITFs are charged for custodianship fees, financial services providers' fees and third-party audit fees whose sum total does not exceed 0.10% of each of the Funds' total volumes. For more information, kindly call (02) 878-4255.

Reference: bdo.com.ph - https://www.affordablecebu.com/